The S&P 500 and the Dow Jones Industrial Average on Monday closed at record highs and Treasury yields stayed below one-year highs as investors analyzed inflation risks following the enactment of the $1.9 trillion relief program.

The Dow ended 174 points, or 0.53%, at a number of 32,953. The index ended higher for the seventh session in a row and reached an intraday record.

The S&P 500 rose for a fifth day, up by 0.65%, and the Nasdaq pushed ahead by 1.05%.

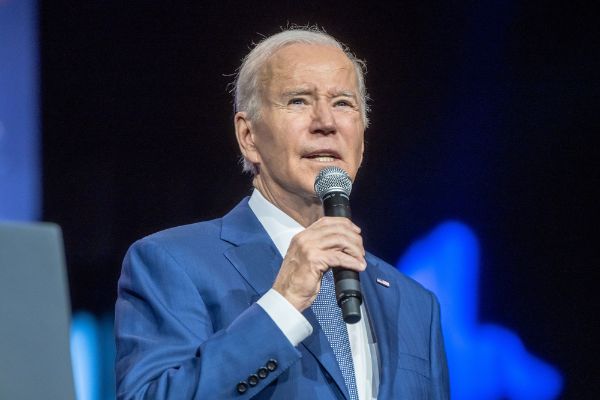

The 10-year Treasury lowered to 1.609% on Monday but stayed elevated. Wall Street’s confidence in a recovery was bolstered by the aid package and President Biden’s promise that all Americans would be eligible to get a coronavirus vaccine by May 1.

Many economists are claiming that inflation will increase with more stimulus. But Treasury Secretary Janet Yellen claimed inflation risks remain under control despite the stimulus.

“The greatest risk we have is a workforce that is damaged by long periods of unemployment,” Yellen said.

“People not being able to find jobs, can have a permanent effect on them. I think that is the greatest risk. Is there inflation risk? There’s a small risk. And I believe it’s manageable.”

Fears of inflation will also be on the minds of investors when the Fed meets this week. Fed Chairman Jerome Powell has stated that inflation will likely rise as the economy recovers but also says it will only be temporary.

The Fed’s two-day event starts Tuesday. And Wednesday, they will announce their decision on interest rates and Powell will hold on a press conference.

“With a Fed announcement coming this week, there might be fear increasing among traders as the market looks for signs that Chairman Powell could be moving away from his plan. But remember, coming from a record week, a small pullback would not be out of the norm,” said Chris Larkin, a managing director at E-Trade.

Comments are closed.