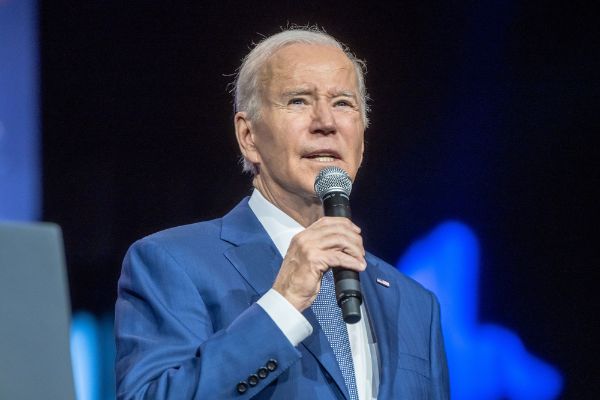

In light of the fact that many Americans are already suffering from the high rates of inflation that have characterized Biden’s rule, President Joe Biden hinted on Wednesday that if he wins reelection this fall, Americans should anticipate paying more in taxes.

In a post on X, Biden asserted that “Donald Trump was quite happy with his $2 trillion tax reduction that largely favored the richest and biggest businesses and increased the government debt.” “That tax break is about to end. That will continue to hold true if I win reelection.

As per a recent assessment by the Tax Foundation, Congress has a little over two years to stop tax rises that will affect “the great majority” of Americans.

The Tax Cuts and Jobs Act (TCJA) of 2017, which lowered taxes “across the income spectrum” and streamlined taxation, is the legislation that Biden wants to see expire.

The report also stated that “the TCJA lower average tax rates for Americans at all income levels because, among other changes, it limited several itemized deductions and the alternative minimum tax, lowered marginal taxes, widened the tax brackets, doubled the child tax credit, zeroed out the personal and dependent exemptions, and almost doubled the standard deduction.” “All income categories saw a reduction in average rates, which have subsequently stayed below their 2017 levels.”

Biden previously promised not to raise taxes on anyone making less than $400,000. This readiness to let the statute expire runs counter to that promise.

“Biden recently approved lowering the child credit down to $1,000 and endorsed a $2 trillion tax rise on earnings under $400k (despite his no-new-taxes vow for such taxpayers),” stated senior fellow Brian Riedl of the Manhattan Institute. The White House’s position on the TCJA is as follows: 1) They insist on ending the “Trump tax cuts” and prepare a budget that claims all deficit savings from the complete expiry of the law, but they also promise to prolong the bottom 98% of the law, which will cost $2 trillion over the course of ten years.

Comments are closed.