While it is too soon to determine if these outflows can be sustained, the data may show some traders are satisfied with the price now and have no plans of selling their bitcoin. In the minds of cryptocurrency watchers, the traders could be transferring their coins to wallets or cold storage while waiting the price to rebound.

Exchanges have reported a net outflow of 22,550 bitcoin this week, the largest single-day amount since November 2, 2020, according to data company Glassnode. The analytics team that tracks movement from 13 exchanges, including Binance and Coinbase.

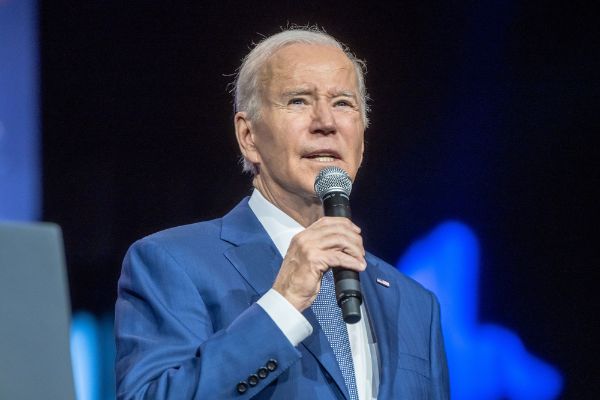

This comes as El Salvador President Nayib Bukele’s announced his goal of making bitcoin legal tender, which has started lifting hopes in the bitcoin market.

Since this announcement, a rush of bitcoin has been taken off exchanges at the greatest rate since last November.

“The outflow is best described as multifaceted, possibly close to HODLing, and the use of the digital currency in decentralized money transfers,” Petr Kozyakov, CEO at Mercuryo, a global payment network told CoinDesk.

The amount of bitcoins being kept in exchange wallets declined to an almost three-week low of 2.54 million, down from 2.56 million.

Investors usually transfer coins from to wallets when they are intending to buy and hold to await price rallies.

“Investors seem to be keeping their assets in offline wallets with the hope for the drop in price to balance out for a fresh price increase higher than its previous record high,” Kozyakov said.

All things taken into account, the latest movement of bitcoin from exchanges points to a bullish future. However, Jason Deane, a Quantum Economics analyst, urges investors to have a cautious mindset.

“The market does not have direction, sentiment is complex and mixed, and many numbers are showing lower demand, so this normally bullish sign should be looked at with caution in this context,” Deane said.

Author: Scott Dowdy

Comments are closed.