This week, Home Depot founder Bernie Marcus issued a rallying cry to the Republican Party, urging them to back former President Donald Trump in his campaign for the White House. Anything less would be inviting catastrophe “for the future of our democracy.”

Marcus stated his case in an online commentary for Real Clear Politics.

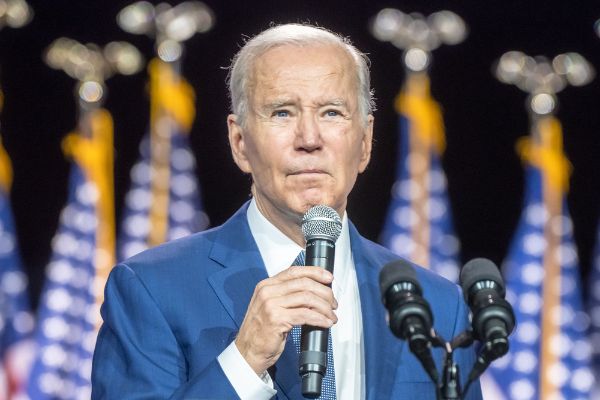

“The government is using its huge powers with contempt for the people instead of consent of the people, as our founders wanted it,” said the 94-year-old, who began by expressing his dismay at President Joe Biden and the “use of enormous powers by the federal government with contempt for the governed.”

He made it apparent that if Democrats hold onto their grip, holding the reins of power, his view for the future is dismal, penning:

“Instead of going through the constitutionally mandated legislative process, fundamental change in America is happening through executive order or the use of the government’s police authorities. I worry that this might lead to the rise of large government socialism in place of free market capitalism. In addition, I worry about the degradation of our liberties and rights, such as freedom of expression, religion, and parenthood, as well as due process.”

“I’ve always believed that a president who poses a danger to democracy will be removed from power by the following election. These days, I don’t feel as confident. My lack of trust stems from the fact that modern media does not function as the watchdog over government that our forefathers intended. Rather, it is the government’s lapdog, keeping the people in the dark about the full extent of the policies and practices of the current administration.”

Marcus—a well-known philanthropist used the opinion article to draw attention to the obvious shortcomings of the Biden administration as well as the reality that traditional media sources won’t criticize him or his allies.

He went on to criticize specific policy failures like the porous southern border, saying, “The Biden administration’s policies encouraged an invasion along our border by millions of illegals, compromised our national security, allowed crime to get out of control in our streets, forced the middle-class to raid their retirement funds to buy food, and divided America more than since the Civil War.” Obama asserted that Joe Biden would “transform” the United States. It appears from Biden’s low job approval ratings that this change is unwelcome.

In the end, Marcus claims that the world views Donald Trump as a capable leader whose actions and the portrayal of his and America’s might “kept the country out of any new foreign confrontations.” Fear of our president by America’s adversaries is vital to our national security.

The essay concluded, “America is worth rescuing.” The “various factions of the Republican Party” should come together in support of Trump and actively participate in the 2024 presidential election as a means of achieving that goal.

Marcus said, “To put it another way, nobody should abstain from voting in the presidential election or stop giving our nominee their financial support.”