This week, former President Donald Trump exclusively informed Breitbart News that he would never touch Medicare or Social Security.

When asked about reducing government waste during a 90-minute exclusive interview, which was his first print interview since securing the Republican presidential nomination for a third consecutive election, Trump promised that he would never slash Social Security or Medicare.

Trump declared, “I would never do anything that would threaten or harm Medicare or Social Security.” “There’s nowhere else we can do it. However, we won’t take any action that may harm them.

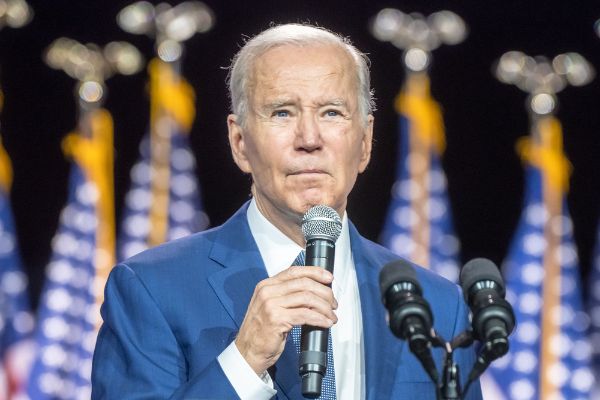

President Joe Biden, a Democrat running against Trump in the general election, has been criticizing Trump in the last several days following an interview with CNBC in which Trump discussed reducing fraud and waste in government spending. Biden has misrepresented statements from Trump in order to give the impression that the president was in favor of eliminating the retirement plans that Americans have become accustomed to as they reach older ages.

However, during his Wednesday night interview at Mar-a-Lago with Breitbart News, Donald Trump made it clear that he would never touch Medicare or Social Security.

According to Trump, “there are a lot of things we can do.” “I won’t do anything to harm Social Security, even if there are so many other sectors where there are so many cuts and waste.”

When asked about entitlement reforms during his CNBC interview this week, Trump stated that he was in favor of reducing fraud and waste, but he also made it clear that he was against cuts to Social Security and Medicare and that Democrats and Biden were the ones endangering these vital programs.

First of all, Trump told CNBC, “There is a lot you can do in terms of entitlements, in terms of reducing.” Furthermore, there are a plethora of options available to address theft and poor entitlement management, including really poor entitlement management.

In his CNBC interview, Trump continued, saying that the policies of Democrats and Biden “end up undermining Social Security because the country is weak.” Look at things other than the stock market, please. We’re experiencing hell. People are suffering greatly.

Biden used Trump’s comments to malign him and suggest that the president is in favor of slashing Social Security. Falsely stating that Trump stated, “There is a lot you can do in terms of slashing Social Security and Medicare,” the Biden campaign posted footage that omits a portion of the Trump quotation. Even though Biden never stated that, the Biden campaign used it as justification. Later, Biden tweeted, “Not under my watch.”

Then, on Monday, during a campaign rally in the Granite State, Biden continued his series of defamatory remarks about Trump by claiming that “many of my Republican colleagues want to put Social Security and Medicare back on the cutting block again.”

In New Hampshire, Biden declared, “I will block anyone who attempts to reduce Social Security or Medicare or raise the retirement age again.” He also stated his belief that Republicans will “slash Social Security and Medicare to give us more tax cuts for the wealthiest.”

On Monday, Biden stated, “Even this morning, Donald Trump declared cutbacks to Social Security and Medicare are on the table again.”

That has, of course, long been untrue in relation to Trump. Trump has consistently vowed to defend Medicare and Social Security, and he reiterated that stance with Breitbart News on Wednesday night.

In December 2022, during his initial interview with Breitbart News at his Miami Doral property after the start of his third presidential campaign, Trump clarified that he would never reduce Social Security.

Then, Trump declared, “We’re not slashing Social Security.” It’s really easy. It’s an easy response. We will not reduce Social Security benefits.

Trump has always maintained his support for preserving Social Security and Medicare. It is also a key factor in why Trump does not get along with traditional establishment Republicans like former House Speaker Paul Ryan, who was a strong advocate of lowering Medicare and Social Security during his tenure in Congress. Ryan, one of the least popular Republicans when he left Congress, lost his attempt for vice president in 2012 while serving as Mitt Romney’s running mate. He currently serves on the board of Fox Corporation, the organization that owns the Fox News Channel.